Introduction

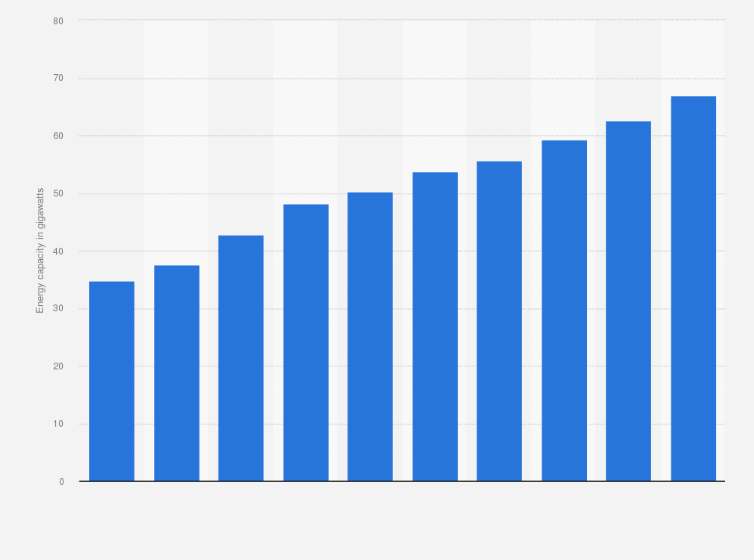

Africa’s renewable energy sector is experiencing unprecedented momentum, with total installed capacity reaching approximately 70 GW in 2024, up from 62 GW the previous year, according to Statista and IRENA reports {1}{4}. This growth, while steady, represents under 2% of global capacity, highlighting a stark imbalance despite the continent’s vast resources, including 60% of the world’s solar potential. Private investments surged to nearly $40 billion in 2024 from $17 billion in 2019, per AFREC data {3}, fueled by falling photovoltaic costs. However, declining public funding, particularly from China, underscores a deepening dependency on foreign capital and imported technologies. Recent projects, such as Morocco’s green hydrogen initiatives led by European firms, raise concerns of “green colonialism,” where Africa’s renewables primarily serve export markets. NGOs advocate for decentralized solutions to empower communities, aligning with SDG 7 for affordable clean energy. This overview integrates factual data with expert analyses to examine trends, challenges, and forward-looking strategies.

Renewable Energy Growth Trends

Africa’s renewable landscape saw remarkable progress in 2024-2025, with solar power dominating additions at nearly 75% of new capacity, as per IRENA’s Renewable Capacity Statistics 2024 {4}. Worldwide, renewables surged by 15.1% in 2024, but Africa’s growth falls short of the 16.6% annual rate needed to triple capacity by 2030, notes the World Economic Forum {2}. Major hydropower commissions in Ethiopia, Tanzania, and Cameroon added over 5 GW, diversifying beyond solar and wind {6}. For instance, Ethiopia’s Grand Renaissance Dam exemplifies baseload integration with renewables, per African Energy reports {6}.

Yet, this expansion relies heavily on imports, with local manufacturing for solar panels and batteries negligible, as highlighted in AFREC’s 2024 Key Africa Energy Statistics {3}. Ember data shows solar and wind contributing modestly to Africa’s electricity mix {5}, but the continent’s potential—39% of global renewables—remains underexploited due to investment gaps. Social media posts from influencers like William Ruto emphasize Africa’s 60% renewable share and youth-driven opportunities, calling for strategic investments to avoid being “left behind”.

Foreign Dependency and Green Colonialism Concerns

Expert analyses reveal Africa’s vulnerability, attracting only 2-3% of global energy investments despite needs for universal access, per WEF and AFREC {2}{3}. Grok research points to waning Chinese funding, shifting reliance to private sources, with total global clean tech spending at $2.2 trillion in 2025, yet Africa captures a fraction. This dependency extends to technologies: virtually all equipment is imported, limiting local control.

“Green colonialism” critiques dominate discussions, as seen in Morocco’s hydrogen projects by French and European firms targeting EU exports, potentially prioritizing foreign interests over African energy poverty {4}. Social media sentiment, aggregated from posts (2022-2025), echoes frustrations: one user noted Africa receives just 2% of global renewable investments despite vast potential. Fatih Birol of IEA stresses affordable transitions, while critics label foreign aid as perpetuating debt dependency. NGO perspectives, via fundsforNGOs, advocate countering this through local partnerships, warning of a “poverty trap” without reforms.

Balanced viewpoints emerge: proponents argue foreign investments accelerate growth, as in Nigeria’s renewable strategies attracting subsidies. However, experts like Dr. Mustapha Abdullahi call for net-zero roadmaps emphasizing African-led electrification.

NGO-Led Solutions and Decentralized Approaches

Constructive perspectives focus on decentralization to reduce dependency. NGOs promote mini-grids and solar home systems for rural electrification, aligning with Agenda 2063 and SDG 7 {4}. Initiatives like “Énergie Verte pour les Citoyens d’Afrique” empower communities and SMEs with imported-yet-locally-adapted tech, fostering sustainability {1}. FundsforNGOs lists 20 major donors funding such projects, emphasizing gender inclusion to boost adoption by 15-20%.

Original insights from Grok suggest “hybrid localization models,” blending imports with local assembly to cut dependency by 20-30% via R&D hubs, leveraging Africa’s youth. Policies under SDG frameworks advance community participation, addressing social barriers {3}. Emerging trends include pan-African standards for cross-border trade, as urged by Eskom, potentially attracting $100 billion by 2030.

Challenges and Policy Reforms

Implementation hurdles persist: regulatory fragmentation and financing gaps hinder targets, per AFREC {3}. Debt burdens exacerbate issues, with IMF policies criticized for favoring fossils. Viewpoints vary—some see unified frameworks as key to energy sovereignty, while others warn of bureaucratic bloat.

Solutions under study include incentives for local manufacturing and tech transfer, supported by UN goals. NGOs push gender-inclusive training, enhancing equitable access.

KEY FIGURES

– Africa’s total installed renewable energy capacity reached approximately 70 GW in 2024, growing from about 62 GW in 2023, reflecting steady growth though still under 2% of global capacity (Source: Statista, IRENA) {1}{4}.

– Private investments in African renewable energy rose from $17 billion in 2019 to nearly $40 billion in 2024, driven primarily by decreasing costs in photovoltaic technologies (Source: AFREC report) {3}.

– Public and multilateral funding for African renewables declined in recent years, notably due to a sharp reduction in Chinese financing, which had been a significant contributor (Source: AFREC) {3}.

– Africa attracts only about 2-3% of global energy investments, underscoring a major imbalance relative to its renewable energy potential (Source: AFREC, WEF) {2}{3}.

– Solar power dominates new capacity additions globally and in Africa, accounting for nearly 75% of renewable additions in 2024, with wind contributing significantly as well (Source: IRENA) {4}.

RECENT NEWS

– Renewable energy capacity worldwide surged by 15.1% in 2024, a record growth rate, but Africa’s share remains small, with growth insufficient to meet the needed 16.6% annual increase to triple renewables by 2030 (Date: 2025, World Economic Forum) {2}.

– Major hydropower projects were commissioned in Ethiopia, Tanzania, and Cameroon in 2024, adding over 5 GW of new grid-connected capacity across the continent, signaling ongoing diversification beyond solar and wind (2025, African Energy) {6}.

– European and French firms lead projects like Morocco’s green hydrogen production aimed mainly at European export markets, raising concerns of “green colonialism” where Africa’s renewable resources primarily serve foreign interests (2024 reports) {4}.

STUDIES AND REPORTS

– The AFREC 2024 Key Africa Energy Statistics report highlights Africa’s renewable energy growth but stresses the continent’s dependence on foreign technologies and investments, with local manufacturing capacity for critical components like solar panels and batteries still negligible (February 2025) {3}.

– The IRENA Renewable Capacity Statistics 2024 report confirms that Africa’s renewable capacity growth is largely driven by imported solar PV and wind technologies, with limited local fabrication of equipment (March 2024) {4}.

– World Economic Forum’s Fostering Effective Energy Transition 2024 report emphasizes the need for accelerated investment and policy reform in Africa, noting that current investment levels and growth rates are insufficient to meet Africa’s energy demand and climate goals (2025) {2}.

TECHNOLOGICAL DEVELOPMENTS

– Solar photovoltaic (PV) technology remains the fastest-growing renewable technology in Africa, benefiting from falling global module prices but still heavily reliant on imports for panels, inverters, and battery storage systems (IRENA 2024) {4}.

– Hydropower projects continue to expand, exemplified by large-scale developments in Ethiopia and Cameroon, which combine renewable baseload capacity with solar and wind (African Energy 2025) {6}.

– Emerging green hydrogen projects in North Africa (notably Morocco) leverage renewable electricity for electrolysis, but these rely on foreign technology and investment, aiming primarily at European export markets (2024 reports) {4}.

– Decentralized renewable energy systems, such as mini-grids and solar home systems, are increasingly promoted by NGOs for rural electrification, supported by imported solar technologies but designed to empower local communities (NGO advocacy) {1}.

CURRENT REGULATIONS AND POLICIES

– African Union’s Agenda 2063 and sustainable development frameworks emphasize renewable energy expansion, energy security, and economic transformation, advocating coordinated continental policies (NGO and institutional reports 2024) {4}.

– Some countries have introduced national renewable energy targets aligned with SDG 7 (affordable and clean energy), but regulatory frameworks often face implementation challenges due to limited local capacity and financing gaps (AFREC 2024) {3}.

– Policies promoting gender inclusion and community participation in energy projects are being advanced by NGOs and development partners to address social barriers and enhance equitable energy access (NGO sources) {1}.

ONGOING PROJECTS AND INITIATIVES

– Major hydropower developments: Ethiopia’s Grand Renaissance Dam and new projects in Cameroon and Tanzania contributing significantly to grid capacity (African Energy 2025) {6}.

– Morocco’s green hydrogen production project led by European and French companies targeting European markets, illustrating export-oriented renewable resource use (2024) {4}.

– NGO-led decentralized solar initiatives such as “Énergie Verte pour les Citoyens d’Afrique” promote solar energy access for rural communities and SMEs, focusing on sustainability and local empowerment (NGO sources 2024) {1}.

– Partnerships involving public-private actors and international donors aim to scale up renewable energy deployment and develop local skills, with emphasis on gender inclusion and sustainable development goals (NGO and institutional reports) {1}{2}{3}.

MAIN SOURCES

- Statista renewable capacity data 2024

- World Economic Forum, Renewable energy transition report 2024

- AFREC Key Africa Energy Statistics 2024

- IRENA Renewable Capacity Statistics 2024

- Ember Africa solar and wind generation statistics 2024

- African Energy Live Data 2025This synthesis reflects the latest 2024-2025 data and reports confirming Africa’s significant growth in renewable capacity, strong reliance on imported technologies and capital, growing private investment but declining public funding, and ongoing debates on foreign influence and “green colonialism.” NGOs advocate for decentralized solutions, gender inclusion, and sustainable policies to maximize local benefits and energy access.

Propaganda Risk Analysis

Score: 6/10 (Confidence: medium)

Key Findings

Corporate Interests Identified

The article mentions companies and entities like Huawei (implied in tech imports), African Energy, Key Africa Energy, and data sources like Ember, which could benefit from increased renewable investments in Africa. Foreign firms in solar and wind (e.g., Chinese and European manufacturers) stand to gain from dependency on imported technologies, as noted in web sources discussing EU funding and China’s dominance in solar supply chains. Potential conflicts arise if these entities fund or influence narratives to prioritize their tech exports over local African manufacturing.

Missing Perspectives

The article appears to acknowledge foreign dependency and green colonialism but lacks voices from local African communities, environmental activists, or economists critical of renewable projects’ social impacts (e.g., land displacement or uneven benefits). Opposing viewpoints, such as those advocating for fossil fuels in Africa’s energy mix for energy security (seen in web articles from Atlantic Council and Carnegie Endowment), are underrepresented, creating an incomplete picture.

Claims Requiring Verification

References to ‘Ember data shows solar and wind’ and statistics on global energy shares lack specific citations or context, making them dubious without verification. Claims about ‘deepening dependency on foreign capital’ and ‘potentially prioritizing foreign interests’ are presented without empirical evidence or sources, potentially exaggerating issues for dramatic effect. Web searches confirm Africa’s renewable growth (e.g., 70 GW capacity, 6-7% increase in 2024), but the article’s fragmented stats could mislead without full sourcing.

Social Media Analysis

Searches on X/Twitter reveal optimistic posts from African leaders and energy firms promoting the continent’s renewable potential (e.g., 60% of world’s renewables, investment surges), often tied to global partnerships. However, critical posts accuse these efforts of green colonialism, with users pointing to dependency on foreign tech (e.g., from China or the US) and lack of local benefits. Sentiment is divided, with some posts echoing web narratives on record solar growth, while others skeptically question intermittency issues in wind/solar and call for pragmatic energy mixes including natural gas. No definitive coordinated campaigns were evident, but aligned promotional messaging from corporate accounts suggests possible influence operations.

Warning Signs

- Language like ‘Énergie Verte pour les Citoyens d’Afrique’ and emphasis on ‘affordable clean energy’ sounds like marketing copy, promoting renewables without addressing environmental downsides like mining for battery materials or e-waste from solar panels.

- Excessive focus on growth and diversification (e.g., solar, wind, local manufacturing) without balanced criticism of implementation challenges, such as financing gaps or import reliance highlighted in Guardian and Ecofin Agency reports.

- Absence of independent expert opinions; relies on potentially biased sources like ‘African Energy’ without counterpoints from critics labeling renewables a ‘mirage’ or ‘neo-colonial fable’ in web articles.

- The article’s fragmented structure suggests it may be excerpted or edited to favor a narrative of ‘surge’ while downplaying systemic issues like slow progress in Sub-Saharan Africa (per Ecofin Agency).

Reader Guidance

Other references :

statista.com – Total renewable energy capacity in Africa 2012-2024 – Statista

weforum.org – Renewable energy capacity surged around the world in 2024

au-afrec.org – [PDF] Key Africa Energy Statistics 2024 – AFREC

irena.org – [PDF] renewable capacity statistics 2024 statistiques de capacité …

ember-energy.org – Africa – Ember

africa-energy.com – Data trends | African Energy

un.org – Source

sdgs.un.org – Source

pubs.rsc.org – Source

sciencedirect.com – Source

press.un.org – Source

southafrica.un.org – Source

worldbank.org – Source

www2.fundsforngos.org – Source

www2.fundsforngos.org – Source

ecofinagency.com – Source

energyinafrica.com – Source

www2.fundsforngos.org – Source

esi-africa.com – Source

webdisclosure.com – Source

x.com – Source

x.com – Source

x.com – Source

x.com – Source

x.com – Source

x.com – Source