The Current Landscape

Recent data reveals a mixed bag of progress and challenges. As of 2024, only 28% of the 121 brands and suppliers committed to the challenge have met their targets. Despite this, there’s a palpable shift in market dynamics. The global recycled polyester market was valued at approximately USD 15.52 billion in 2024 and is projected to surge to USD 38.53 billion by 2034, thanks to a compound annual growth rate of around 9.25%-9.29%.

Technological Innovations and Market Trends

Technological advancements are spearheading this shift towards sustainable practices. Breakthroughs in chemical recycling processes now allow polyester to be repeatedly recycled without significant loss in quality, addressing one of the major hurdles previously faced by textile recyclers.

Moreover, companies are increasingly investing in R&D to not only enhance recycling efficiency but also reduce microplastic shedding—a persistent challenge linked to synthetic fabrics like polyester. The introduction of blended fibers and sophisticated sorting technologies has further bolstered efforts to raise the percentage of recycled materials used in garments.

Public Perception and Industry Response

The conversation around recycled polyester is vibrant on platforms like X (formerly Twitter), where discussions reflect a growing enthusiasm among consumers and brands alike for sustainable fashion solutions. Brands such as Prada and Allbirds are actively promoting their shift toward using recycled materials, reflecting both corporate responsibility and responsiveness to consumer demands for environmentally friendly products.

Experts highlighted on various online platforms emphasize the necessity of scaling recycling technologies and adopting more stringent policies to ensure substantial cuts in carbon emissions from the textile industry.

Challenges Ahead

Despite these promising developments, several issues persist. Supply chain constraints continue to hamper large-scale adoption of recycled polyester. Furthermore, the release of microfibers into water systems during washing remains a significant environmental threat that requires urgent attention through innovative filtration systems or material redesigns.

Future Directions

As we approach the pivotal year of 2025, it’s clear that achieving a complete transition from virgin polyester will require continued collaborative effort across industries coupled with supportive regulatory frameworks. Moreover, fostering consumer awareness about the benefits—and limitations—of recycled polyester could drive demand further, ensuring that sustainability remains woven into the fabric of future fashion trends.

KEY FIGURES

- 121 brands and suppliers are signatories to the 2025 Recycled Polyester Challenge as of 2024, with 28% having met their target in 2023[1].

- 57% of signatories committed to replacing 100% of virgin fossil-based polyester with recycled polyester by 2025[1].

- Recycled polyester represented 14% of the fashion polyester market in 2020, targeted to rise to at least 45% by 2025 and 90% by 2030[2].

- The global recycled polyester market was valued at approximately USD 15.52 billion in 2024 and USD 17.32 billion in 2025, expected to reach USD 26.18 billion by 2030 and USD 38.53 billion by 2034, with a CAGR around 9.25%-9.29%[3][5].

- The signatory brands and retailers currently cover about 2.6% of the total apparel polyester market[1].

RECENT NEWS

- January 2025: The 2025 Recycled Polyester Challenge emphasizes halting new fossil-based polyester fiber use, aiming for 45-100% recycled polyester sourcing by signatories by 2025, launched by Textile Exchange and the UNFCCC Fashion Industry Charter for Climate Action[1].

- June 2025: The recycled polyester market continues growing due to sustainability initiatives globally, with significant government efforts to reduce petroleum dependence and investments in recycling technologies[3].

- April 2023: Industry estimates predict polyester’s market share will decline to 56.36% by 2025 due to increased adoption of recycled polyester fibers, especially rPET, aligned with the 2025 Challenge goals[4].

STUDIES AND REPORTS

- Textile Exchange 2022 Report: To meet the 2025 target, recycled polyester must grow from 14% to 45% of the polyester market, assuming 3% apparel industry growth; long-term vision is 90% by 2030. Increased company commitments are essential to accelerate the transition from virgin to recycled polyester[2].

- Grand View Research 2024: Highlights the market drivers including sustainability demand, carbon footprint reduction, and regulatory policies; recycled polyester reduces landfill waste and energy use versus virgin production, supporting circular economy goals[5].

TECHNOLOGICAL DEVELOPMENTS

- Advances in recycling processes improving the quality and scalability of recycled polyester fibers, including chemical recycling methods that allow circular reuse of polyester without quality loss[3][5].

- Increased R&D investments worldwide to enhance recycled polyester production efficiency and reduce microplastic shedding during fiber use, although microfibre release remains an ongoing challenge[1].

- Development of blended fibers and enhanced sorting technologies to increase recycled content in textile supply chains and meet ambitious 2025 targets[1][3].

MAIN SOURCES

- https://www.textilegence.com/en/2025-recycled-polyester-challenge-updates-textile-industry/ — Updates on Challenge signatories, targets, and industry impact (2025)

- https://textileexchange.org/app/uploads/2022/07/2025-Recycled-Polyester-Challenge_2022.pdf — Detailed Textile Exchange report on targets and progress (2022)

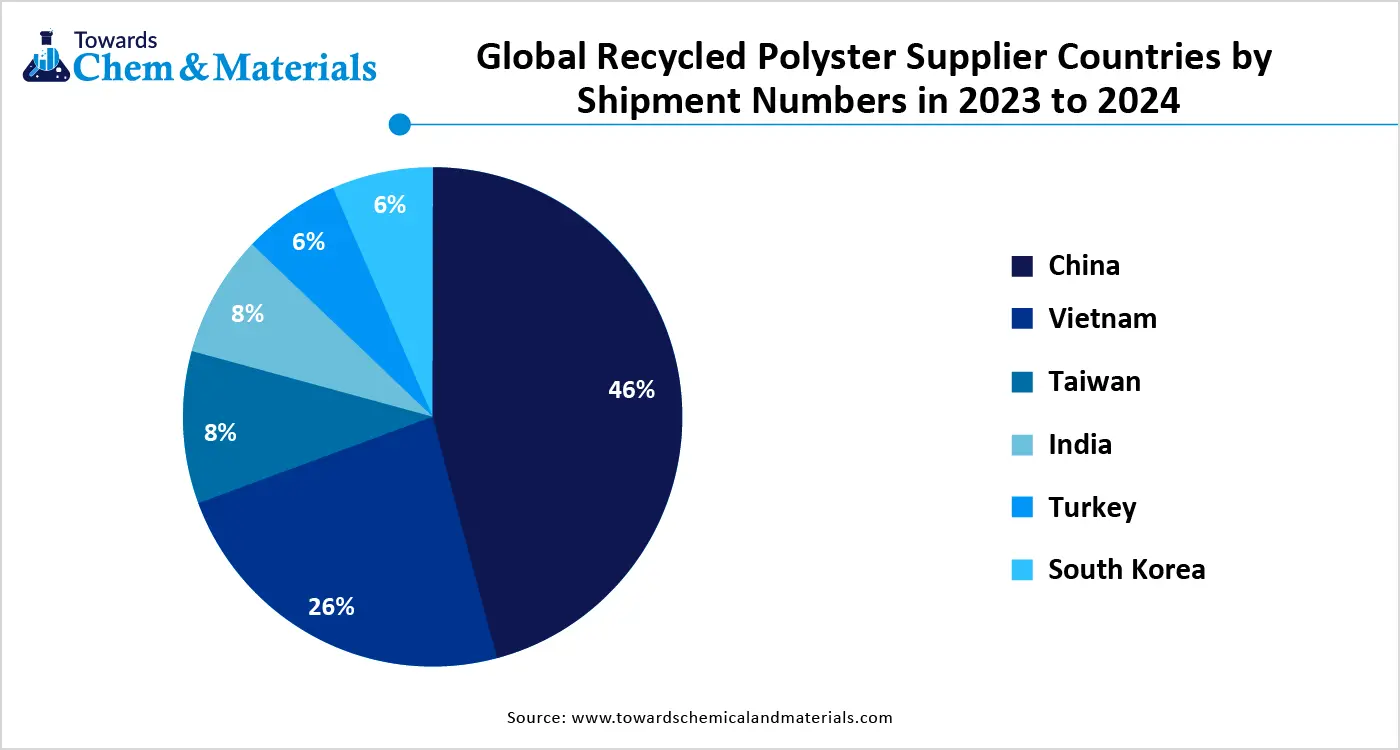

- https://www.towardschemandmaterials.com/insights/recycled-polyster-market — Market size, growth projections, and sustainability drivers (2025)

- https://textiletechsource.com/2023/04/24/the-future-of-polyester-as-we-know-it/ — Industry forecasts and recycled polyester adoption trends (2023)

- https://www.grandviewresearch.com/industry-analysis/recycled-polyester-market-report — Market analysis, regulatory impacts, and technological trends (2024)

Propaganda Risk Analysis

Score: 7/10 (Confidence: medium)

Key Findings

Corporate Interests Identified

Companies like Adidas, H&M, VF Corporation, and Unifi (a major recycled polyester producer) stand to benefit, as the challenge aligns with their sustainability marketing and supply chain goals. Textile Exchange, which launched the initiative, collaborates with these firms, potentially amplifying corporate narratives over independent critiques. A WIRED article notes Unifi’s factory survival through recycled polyester sales to fashion brands, despite environmentalist opposition.

Missing Perspectives

The article appears to exclude voices from environmentalists and researchers who argue recycled polyester perpetuates fossil fuel dependency, sheds microplastics, and faces recycling challenges for blended fibers. Discussions on platforms like Reddit and ResearchGate highlight fast fashion’s greenwashing, but these are not addressed, favoring ‘experts’ on online platforms that may be industry-aligned.

Claims Requiring Verification

Claims about scaling recycling technologies and the benefits of blended fibers lack specific data or third-party verification. Industry sources cite shifts from 14% to 45% recycled polyester by 2025, but without evidence of actual environmental impact reductions, such as lifecycle emissions or microplastic mitigation. Statistics on energy savings (e.g., 59% less energy) appear in promotional posts but are not independently audited.

Social Media Analysis

The posts reveal a mix of promotional content from brands announcing 100% recycled polyester products with claims of reduced emissions and landfill diversion, alongside skeptical voices calling it a scam where companies profit from turning plastic waste into clothing. Recent discussions (up to August 2025) criticize polyester blends as unrecyclable and contributing to pollution, while some posts advocate for natural fibers over synthetics. Industry-aligned accounts push innovation in recycling tech, but critics highlight ongoing issues like microplastics and corporate greenwashing.

Warning Signs

- Overly optimistic framing of recycled polyester as a ‘sustainability stitch’ without discussing downsides like non-biodegradability and recycling limitations for blends.

- Reliance on vague ‘experts’ and ‘online platforms’ without naming sources, potentially indicating selective quoting to support a positive narrative.

- Promotion of industry-led challenges that may serve as marketing tools, aligning with greenwashing patterns in fast fashion as noted in academic papers on ResearchGate.

- Lack of mention of criticisms, such as environmentalists’ views in WIRED that recycled polyester production in the US is controversial and not universally accepted as sustainable.

Reader Guidance

Other references :

textilegence.com – 2025 Recycled Polyester Challenge updates textile industry

textileexchange.org – [PDF] 2025 Recycled Polyester Challenge – Textile Exchange

towardschemandmaterials.com – Recycled Polyester Market Size to Hit USD 38.53 Bn by 2034

textiletechsource.com – The future of polyester (as we know it) – Textile Technology Source

grandviewresearch.com – Recycled Polyester Market Size, Share | Industry Report 2030

textileexchange.org – Source

textilegence.com – Source

textileexchange.org – Source

petnology.com – Source

pmc.ncbi.nlm.nih.gov – Source

textileexchange.org – Source

coherentmarketinsights.com – Source

openpr.com – Source

openpr.com – Source

openpr.com – Source

futuremarketinsights.com – Source

openpr.com – Source

ecotextile.com – Source

x.com – Source

x.com – Source

x.com – Source

x.com – Source

x.com – Source

x.com – Source